Appalicability

All UnionPay issued credit cards and signature-based debit cards are required to support UnionPay CNP transactions.

The issuer is required to fill in and submit the UnionPay Card Information Form (409), which specifies the credit and signature-based debit BINs information, and complete the system testing before launching the business.

For some BINs, which have launched businesses and do not support CNP transactions, the issuer may fill in and submit a BIN Usage Change Form (408) and complete the related system testing.

Scenarios

MO/TO Transactions

Recurring Transactions

In-Flight Commerce Transactions

Tax Recollection Transactions

Hotel Reservation/Car Rental CNP Transactions

Payment Flow

MOTO process:

The cardholder orders goods or services through telephone/fax/mail.

The merchant initiates the MO/TO transaction and submits information to the acquirer.

UnionPay checks the validity of the online transaction and switches it to the issuer.

The issuer authenticates the transaction information and sends a response based on the verification.

The merchant delivers the merchandise or service.

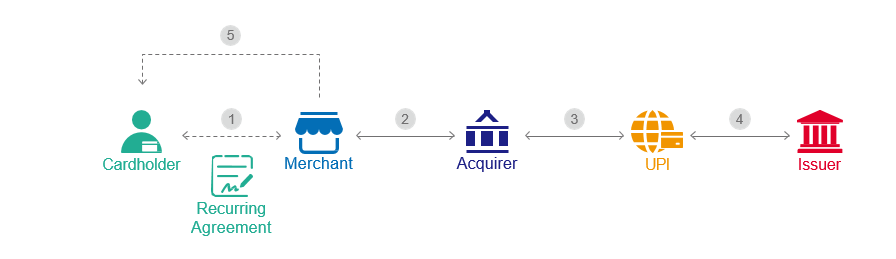

Recurring is based on the service agreement between the merchant and cardholder that, within a certain period, the merchant can charge the cardholder directly, such as a utility fee.

Sign a service agreement to establish a recurring relationship.

The merchant submits the transaction requests periodically during the service period.

UnionPay checks the validity of the online transaction and switches it to the issuer.

The issuer authenticates the transaction information and sends a response based on the verification.

The merchant must notify the cardholder of the periodical payment results.

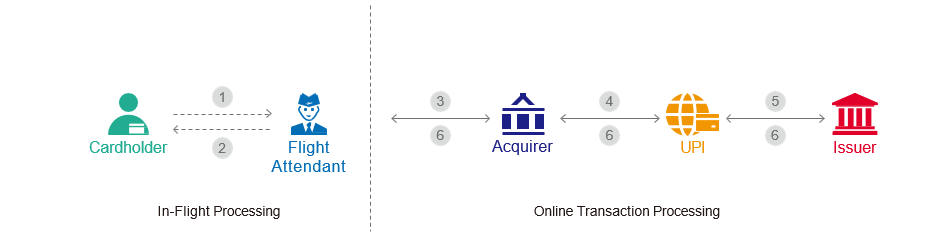

In-Flight Commerce is when on a flight the merchant (attendant) acquires the card number and expiry date and raises a CNP transaction after landing.

The cardholder makes a purchase with a UnionPay credit card or signature-based debit card aboard a flight.

The attendant verifies the card and swipes, inserts or imprints the card to obtain the card information.

* The POS terminal on the flight should have uploaded a BIN list and a blacklist.

The merchant must submit the recorded transaction details to the acquirer within 24 hours of landing.

The acquirer initiates the transaction to the issuer for online authorization and switches it to the issuer.

UnionPay forwards the valid transaction to the issuer.

The issuer verifies the transaction and sends the response to UnionPay. UnionPay then forwards the response to the acquirer. The acquirer sends a response to the merchant.

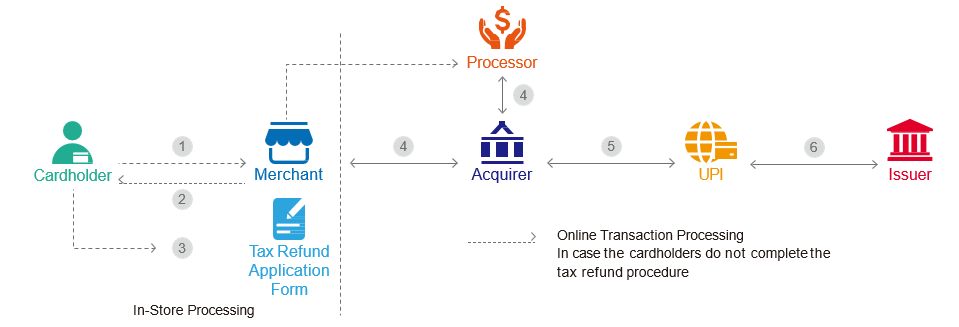

Tax Recollection is when the tax gets directly deducted from bill for eligible merchants.

If the tax refund was not submitted upon departure, the tax will be charged to the card.

The customer provides a guarantee for tax collection in case the customer fails to complete the tax refund procedures at customs.

The cashier verifies the cardholder’s identification and then swipes, inserts, or imprints the card to obtain the card information.

The cardholder signs a Tax Recollection agreement.

The merchant or tax refund service provider initiates a Tax Recollection transaction and sends the transaction to UnionPay.

UnionPay verifies all the online transactions submitted by the acquirer.

The issuer authorizes the transaction and sends the response back to UnionPay. UnionPay then sends the response back to the acquirer. The acquirer must inform the merchant/service provider of the transaction result.

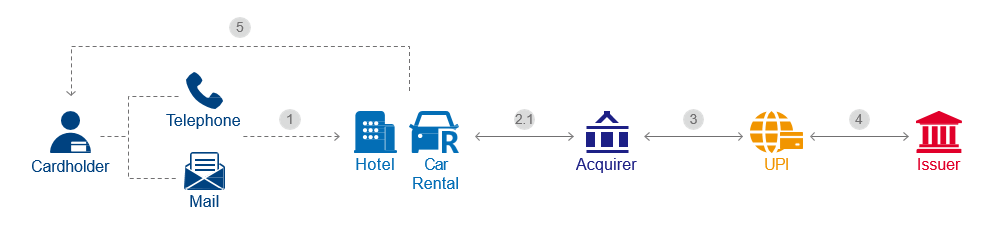

For Hotels and Car Rental Companies (by MCC), Pre-Authorization and Purchase transactions can be done by Manual Key-In.

The cardholder makes the reservation via telephone, email or other non-face-to-face channels.

The merchant conducts a key-in pre-authorization transaction, obtains the cardholder’s card information, and gives the information to the acquirer.

The cashier keys in the card number, expiration date, and amount on the POS terminal to initiate a pre-authorization transaction.

UnionPay checks the validity of the online transaction and switches it to the issuer.

The issuer authenticates the transaction information and sends a response based on the verification.

The merchant delivers the merchandise or service.

Use Case

1 . MOTO

Exam registration fees, membership fees, purchasing air tickets, etc.

2 . Recurring

Utility fees, telecom fees, broadband fees, etc.

3 . In-Flight Commerce

Purchasing goods on a flight.

4 . Tax Recollection

Merchants provide goods whose tax gets directly deducted from the bill.

5 . Hotel Reservation and Car Rental

Booking hotel rooms or cars online or by telephone, and then the merchant keys in the card info and makes the authorization for the customer.

Features

Supports various sending channels including online and offline.

Simple & relatively low-fee structure.

Secure UnionPay Network

Kindly Reminder

Kindly Reminder