Appalicability

For overseas collection institutions: It must be an overseas licensed payment institution, and it needs to sign a cooperation agreement with a domestic payment institution or bank. At the same time, it monitors the compliance of merchant platform transactions and provides UnionPay International with authenticity materials corresponding to each transaction.

For domestic institutions: It must be a domestic licensed third-party payment institution or bank. In this project, it is mainly responsible for three areas. The first is to conduct access review and transaction risk verification and compliance management for domestic export sellers. The second is to act as the initiator of the collection request for domestic export sellers and be responsible for the authenticity and compliance of each data collection.

Scenarios

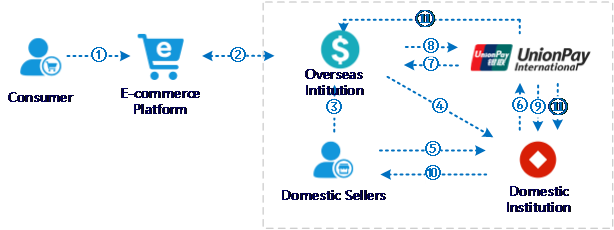

The product is used by overseas collection institutions to clear e-commerce platform sales funds to domestic sellers through domestic institutions.

Payment Flow

Pre-step: Consumers make payment on the overseas e-commerce platform.

Pre-step: The overseas e-commerce platform synchronizes the order information with the overseas institution.

Domestic sellers log in to the overseas institution to check their account balance.

The overseas institution instructs the domestic seller to the withdrawal page provided by the domestic institution.

The domestic seller confirms the service agreement on the domestic institution withdrawal page and submits the withdrawal application.

The domestic institution initiates the withdrawal request to UnionPay International.

UnionPay International forwards the withdrawal request to the overseas institution.

The overseas institution processes the withdrawal request and sends a response, while pushing the order data from the overseas e-commerce platform to UnionPay International.

UnionPay International forwards the response to the domestic institution.

The domestic institution informs the domestic seller that the cash withdrawal was successful and gives the seller an estimated arrival time.

UnionPay International generates settlement reports and sends them to the overseas / domestic institution for subsequent reconciliation.

Use Case

1 . PingPong

The product has been used in several top overseas funds collection institutions, such as PingPong.

Features

As a cross-border transfer and clearing organization, UnionPay International will be responsible for the transfer and clearing of information exchanges between overseas institutions and domestic institutions.

Kindly Reminder

Kindly Reminder