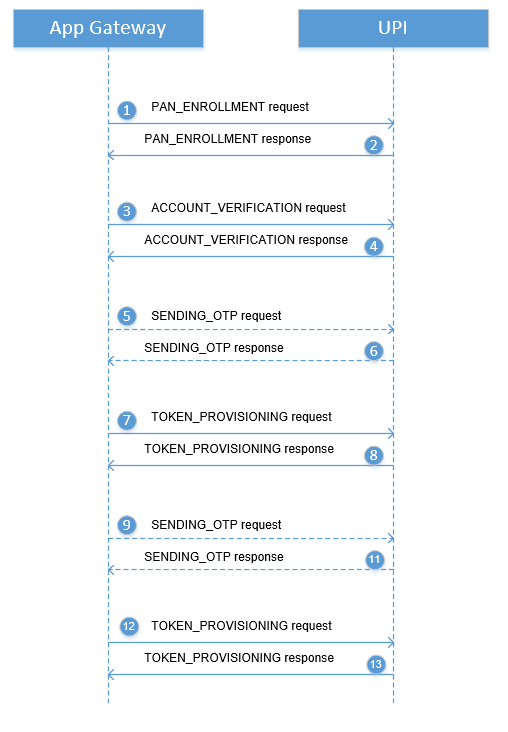

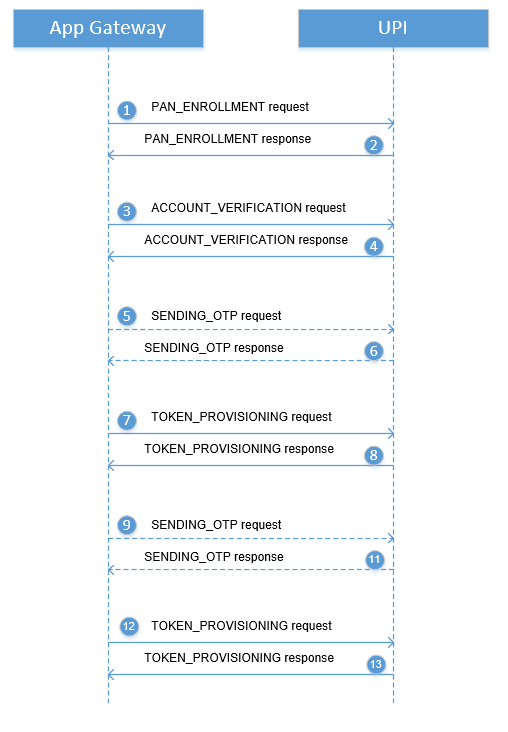

Account Enrollment

The following figure illustrates the flow of account enrollment performed by the mobile application through UnionPay network.

1. PAN_ENROLLMENT request

The mobile application allows the user to scan or enter the details of existing cards in order to digitize these cards. The application gateway sends PAN_ENROLLMENT request to the UPI.

a. Device ID is the unique identifier in the mobile handset, such as Android ID or IMEI number.

b. Wallet ID is the identifier assigned by the UPI to identify the mobile application, as the Issuer may have more than one mobile application with different risk parameters for the tokens.

c. PAN is the card number of the payment card

2. PAN_ENROLLMENT response

The UPI sends a request to Issuing Host to check the status of the physical card, and returns the result in the PAN_ENROLLMENT response with the following information:

a. Enrollment ID is the unique identifier to keep track of this account provisioning process.

b. List of CV is the list of account verification data to be captured from the Cardholder for verification of the identity of the Cardholder.

c. TNC URL is a link of the Terms and Conditions (TNC) to be displayed to the Cardholder

3. ACCOUNT_VERIFICATION request

The mobile application will download and display the Terms and Conditions for the Cardholder to accept or decline. If the TNC is declined, the enrollment process will terminate. Otherwise, the mobile application will capture the Cardholder Verification Information that was requested from the UPI, and send them in the ACCOUNT_VERIFICATION request.

4. ACCOUNT_VERIFICATION response

The UPI can send these data to the Issuer to validate the Cardholder Verification Information captured from the Cardholder, and return the validation result in the ACCOUNT_VERIFICATION response message. If the OTP is required, the UPI will also inform the mobile application of the allowed OTP methods:

a. SMS OTP

b. Email OTP

c. Call Center OTP

d. Web Application OTP

5. SENDING_OTP request

The mobile application will display the allowed methods to the Cardholder. After the Cardholder chooses one, the mobile application will send SENDING_OTP message to the UPI, and the Issuer, or a processor on behalf of the Issuer, will send an OTP to the mobile phone number of the Cardholder.

6. SENDING_OTP response

The UPI will return the OTP length, expiry time, and maximum attempt number in the response message. If the Cardholder does not receive the OTP, the application can send another SENDING_OTP message to the UPI.

7. TOKEN_PROVISIONING request

The Cardholder enters the OTP in the mobile application, and the mobile application will send it in the TOKEN_PROVISIONING request, along with the accepted TNCID.

8. TOKEN_PROVISIONING response

The UPI sends the OTP data for validation. If the validation is successful, the UPI will return the Token information to the application gateway.

9. CARDFACE_DOWNLOADING request

The mobile application can request to download the card face to display it to the Cardholder.

10. CARDFACE_DOWNLOADING response

The UPI returns the card face data and the recommended PAN location in the CARDFACE_DOWNLOADING response.

11. TOKEN_STATE_UPDATE request

After loading Token information and completing the mobile application offline configuration, such as Consumer device, Cardholder Verification method, transaction amount limit, etc., the mobile application will send the TOKEN_STATE_UPDATE request to activate the Token for use in the payment.

12. TOKEN_STATE_UPDATE response

The UPI returns the result and the latest Token state in the TOKEN_STATE_UPDATE response message, and the enrollment process is completed.

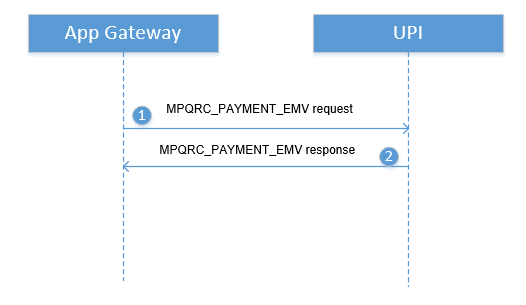

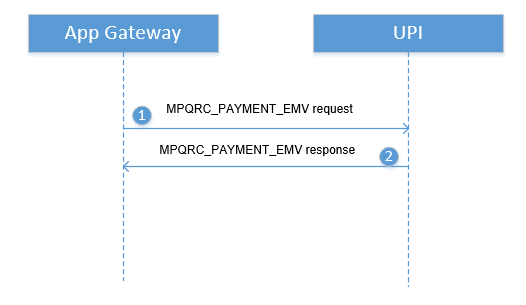

Merchant-presented QR Code Payment (EMV Mode)

After the consumer scans an EMV standard merchant-presented QR code, the merchant information shall be displayed on the application. After the consumer input required information, such as amount, loyalty number, etc. and confirm a purchase, the mobile application will initiate a QRC payment message to request an authorization from issuer. The payment message can be a purchase message, authorization message, etc. The message flows are as follow.

1. The application gateway submits a MPQRC_PAYMENT_EMV request message to UMPS (UnionPay Mobile Payment system).

2. The UMPS returns the transaction outcome to the application gateway in the MPQRC_PAYMENT_EMV response.

Exceptional flows:

Application gateway: When the application gateway does not receive the MPQRC_PAYMENT_EMV response message within 65 seconds, the application shall initiate a TRX_RESULT_INQUIRY message to check if the payment is successful.

Merchant-presented QR Code Payment (URL Mode)

After the consumer an URL standard merchant-presented QR code, the mobile application will initiate a merchant information inquiry message to request the merchant name, merchant ID etc. Once the consumer confirms the payment, the mobile application will initiate a payment message to request an authorization from issuer. The payment message can be a purchase message, authorization message, etc. The message flows are as follow.

1. The application gateway submits a QRC_INFO_INQUIRY request to the UnionPay Mobile Payment System.

2. The UnionPay Mobile Payment System returns the merchant information details to the application gateway in the QRC_INFO_INQUIRY response.

3. After the consumer confirms the payment and enters the transaction amount (if required), the application gateway submits a MPQRC_PAYMENT_URL request message to the UnionPay Mobile Payment System.

4. The UnionPay Mobile Payment System returns the transaction outcome to the application gateway in the MPQRC_PAYMENT_URL response message, and is responsible to notify the acquirer of the transaction outcome.

Exceptional flows:

Application gateway:

1. When the application gateway does not receive the QRC_INFO_INQUIRY response within 10 seconds, it may initiate the inquiry again.

2. When the application gateway does not receive the payment response message within 65 seconds, it shall initiate a TRX_RESULT_INQUIRY message to check if the payment is successful.

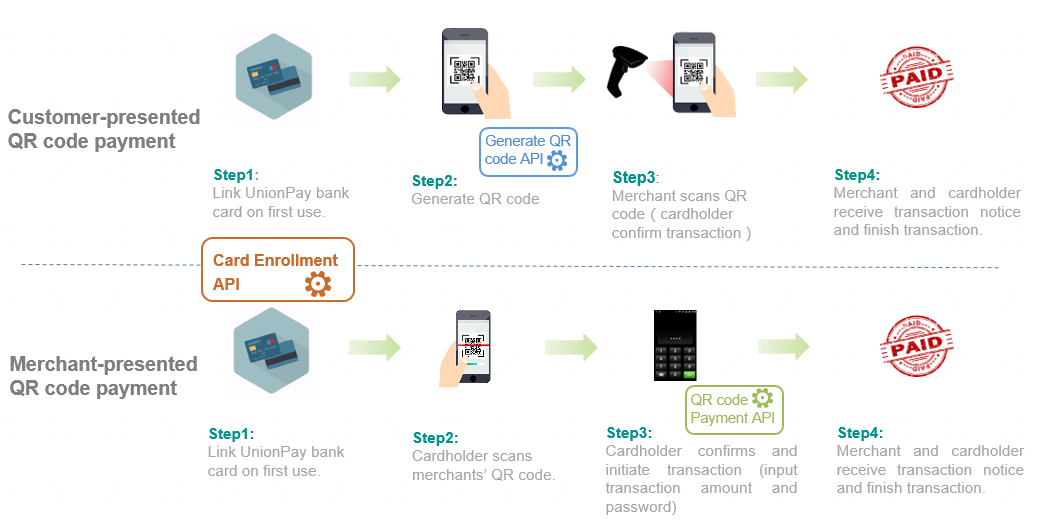

Consumer-presented QR Code Payment

After the merchant scans the QR Code presented in the mobile application, the merchant will a QRC payment message to request an authorization from issuer. The payment message can be a purchase message, authorization message, etc. The message flows are as follow.

1. The merchant submits a payment request message to the UPI System. The UPI System will check if the transaction amount is below the wallet’s CVM limit. If yes, the transaction flow goes to step 2. Otherwise, The UPI request authorization from the issuer if the additional processing response is positive. If not, UPI will reject the payment and send the result to the acquirer, which is beyond this work flow

2. UPI sends ADDITIONAL_PROCESSING request to the application gateway.

3. The application gateway acknowledges by sending the ADDITIONAL_PROCESSING response. Then the application gateway will request the application to perform CDCVM validation. The application will perform additional CDCVM, which is beyond the scope of this flow.

4.The application can approve or reject the transaction for a risk reason at this moment and send the result back to the application gateway. The application gateway will inform the UPI by the ADDITIONAL_PROCESSING_RESULT request.

5. The UPI acknowledges by sending back the ADDITIONAL_PROCESSING_RESULT response.

6. The UPI returns the transaction outcome to the application gateway by the TRX_STATUS_NOTIFICATION request.

7. The application gateway returns the TRX_STATUS_NOTIFICATION response message to acknowledge that the advice is well-received.

Exceptional flows:

1. Application gateway: When the application Gateway does not receive the TRX_STATUS_NOTIFICATION, no action is required.

2. When the UPI does not receive the additional processing advice within 60 seconds, the transaction will be rejected.

Kindly Reminder

Kindly Reminder